Loans Disbursed

Employees

Happy Clients

Cities Served

LoanTrust.in is your one-stop destination for all types of loans, and investment products in India. Born with an aim to make your personal finance decisions easy, convenient and transparent for our customers. LoanTrust is the largest online portal for lending loans and other financial dispersals. In recent times, LoanTrust has helped a lot of individuals to realize their dreams by serving their capital needs with complete transparency. Our goal is to help people compare and choose from various financial products across categories such as personal loans, home loans, credit cards, education loans, car loans, savings accounts and mutual funds. We work with leading banks and NBFCs to fulfill customer loan requirements.

Loads of Reasons to Sign Up with LoanTrust & Enjoy Awesome Benefits!

LoanTrust was born in the mid-2015, to ease the pain of customers in getting the best deals on a wide range of financial products like personal loans, home loans, business loans, checking credit score etc. LoanTrust is the only neutral online marketplace for instant customized rate quotes on loans helping you to shop for loans & cards just like you buy everything else now - online. This happens real-time which ensures that you get the best rate always. We have tie-ups with all the major banks and NBFCs which provide loans and also take quick strides to reach the mind of people through our hard work, transparency and seamless customer services.

Through LoanTrust we try to offer you a technology platform which helps you save maximum money from your financial requirements like personal loans, home loans, business loans etc. We try to make your life simple by acting as a mediating platform between financial institutions like banks/NBFCs/money changers and people like you. We take your request to these institutions and try to get you the best product/service/deal from their many offerings.

- Enjoy Financial solutions for a Lifetime

- Make Informed Financial Decisions

- Compare with multiple banks

- Free financial assistance

- Get seamless financial support

- Attractive Cashback offers

Frequently Asked Questions (FAQs)

By using LoanTrust you get Credit Evaluation is done and instant loans through our affiliate banks and NBFCs.

Product offered on Loantrust platform are flexible and custom made for you. The speed of disbursal, No Penalty on Pre-Payment* (Part or Full), Lower cash outgo, Higher loan amount and all our services are doorstep.

Each consumer wishing to borrow on the LoanTrust website will need to go through rigorous verification and credit assessment process. The assessment is based on information collected from various data sources like the application form, credit bureaus, bank statements, pay slips, verification reports, social media, etc. The above process is automated and happens within seconds. Hence, you can get an approval shortly after you submit your application.

Yes, at LoanTrust, we help you to get personal loans starting from Rs. 25,000 up to Rs.25 lakhs for 1 to 5 years.

Yes, you can pre-pay your loan as and when you want.

The reason your application was rejected was that your credit profile did not match the criteria stipulated in the policy provided by the financial institution at the time. However, the institution might be able to approve your application at a later date, if by then your credit file has improved or there have been changes in the policy.

Lenders will have the ability to view detailed profiles of the borrowers, information like financial information, employment information, etc. The personal knowledge of the borrower remains protected as per our privacy policy.

At LoanTrust we ensure 100% safety & transparency to carry out every truncation through online process only. Soon after the loan is approved, the funds will be transferred right into your bank account.

A credit score is the measure of an individual’s creditworthiness. The higher the score, the better-placed one is to have access to any credit– a credit card, a personal loan, a car loan or even a home loan. It is usually a three digit number between 300 and 900 which is calculated based on the individual’s repayment history on credit products.

Yes, free to check your credit score on LoanTrust.

Credit report, which is provided by CIBIL, is a report card based on your performance on loans. Banks use this information to assess your loan applications. It is the single most significant criteria for evaluating your loan application.

KYC documents help us identify you. We want to make sure that we share your credit report with you and only you. We only ask for documents that banks recognize as a form of KYC, e.g., Passport, Aadhaar, Bank Statements, etc.

The Bank / NBFC issues its customer a “No Due Certificate” on the closure of the loan.

Yes, we offer Top up facility if you have paid 6 EMI on the existing Personal Loan.

No security or collateral or guarantors are required for obtaining loans.

For LoanTrust, data security is of utmost priority. All of your data is kept strictly confidential and is shared with the funding institution of your choice, based on your application.

Our affiliate NBFCs don't levy any pre-closure charges, post six months of Interest servicing

At LoanTrsut, we promise you there are no hidden charges. The complete list of Fee and Interest are provided at the time of disbursal as part of loan schedule. Our affiliate NBFCs levy only one-time processing fee equal to 2% plus applicable Taxes, of the sanctioned amount. Particular Purpose Loans can carry higher processing fees.

Our affiliate NBFCs offer loans with durations anywhere between 1 year to 5 years. Individual purpose loans are provided from 10 Days to 33 months, as per the agreement term.

Through NACH to our affiliate NBFCs wherein your account will automatically get debited on due dates.

Pan Card Copy, 6 Months Bank statement of salary account, Latest salary slip and Address Proof.

Current Rate of Interest

| Product Type | Rate of Interest starts % |

|---|---|

Personal Loan

|

10.25% |

Home Loan

|

7.15% |

Loan Against Property

|

8.70% |

Business Loan

|

13.50% |

Professional Loan

|

12.99% |

Doctor Loan

|

11.25% |

Two Wheeler Loan

|

8.5% |

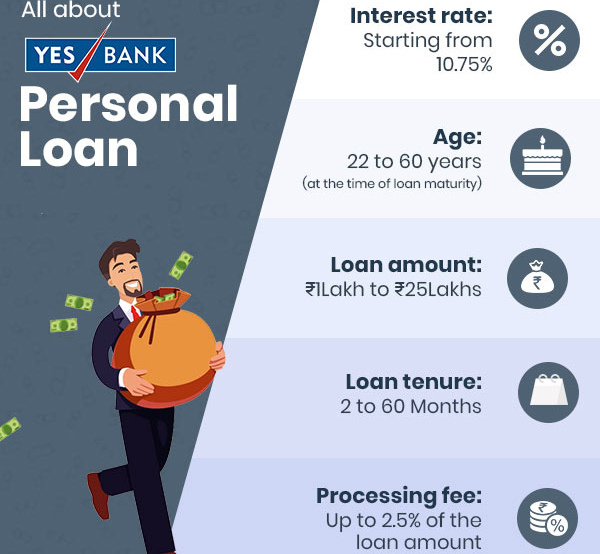

Personal Loan Rate of interest

| Service type | Interest rate |

|---|---|

| Rate of interest | Min ROI: 10.25% - Max ROI: 18% |

| Loan Processing charges | Up to 2.5% of the loan amount subject to a minimum of Rs.1000/- |

| Minimum Repayment Period | 12 Months |

| Maximum Repayment Period | 60 Months |

| Prepayment | No prepayment permitted until repayment of 12 EMIs for salaried |

| Pre payment Charges | For salaried: 13-24 months- 4% of the Principal Outstanding 25-36 months- 2% of Principal Outstanding > 36 months-Nil |

| Charges for the late payment of EMI | 24% per annum on amount outstanding from the date of default |

| Cheque bounce charges | Rs. 450/- per cheque bounce |

Representative Example

For example if a person borrowed a loan of Rs. 5,000,00/- with a rate of interest 12% per annum for 60 months. Then monthly EMI is Rs. 11,122/- per month

Latest News

Customer Testimonials

Our Head Office

1370/1, JMJ complex,

Devarachikkana Halli cross,

Begur Main Rd Bengaluru, Karnataka 560068

Phone: +91 7019863505

Email: info@loantrust.in

Working Hours:

Mon-Sat: 9AM to 9PMSunday: Closed